Struggling with bad breath? You’re not alone.

Dental care is an important aspect of maintaining our overall health and well-being. However, understanding and navigating through dental benefits can often be a confusing and overwhelming process. With various health fund plans and coverage options available in Australia, it's crucial to have a clear understanding of what your health fund covers when it comes to dental treatment.

In this blog post, we will provide you with some informative insights to help you better understand your dental benefits and make informed decisions about your oral health.

First and foremost, it’s essential to familiarize yourself with the terms and conditions of your health fund policy. This includes understanding the specific dental services covered, any waiting periods associated with certain treatments, annual limits, and any restrictions or exclusions that may apply. By thoroughly reviewing your policy, you can gain a better understanding of what treatments are covered and to what extent for you.

When it comes to dental treatment, health funds generally categorize services into three or four main groups, these can vary depending on the health fund and policy.

Most health funds cover preventative services to a significant extent, often providing fully covered or heavily subsidized treatments. This encourages patients to prioritize preventive care, as it not only promotes oral health but can also help prevent more expensive and invasive procedures in the future.

For general dental services, health funds typically offer a percentage-based coverage. This means that they will reimburse a certain percentage of the cost, while the remaining amount is the patient’s responsibility. The coverage percentage may vary depending on the specific treatment and the level of coverage chosen in your policy. It’s important to note that there may be annual limits on general dental services, so it’s wise to budget and plan accordingly.

When it comes to major dental services, coverage can be more limited. Health funds often impose waiting periods before they provide coverage for major treatments. Waiting periods typically range from six months to two years, depending on the specific procedure. It’s crucial to be aware of these waiting periods to ensure you are adequately covered when you need major dental work done.

In addition to understanding your policy’s coverage, it’s also important to consider the network of dental providers affiliated with your health fund. Many health funds have preferred provider networks, where they have negotiated lower fees with specific dentists. By choosing a dentist within your health fund’s network, you can often take advantage of reduced out-of-pocket expenses. We are preferred providers for Medibank Private at our Tecoma and Forest Hill practices and HCF at all three of our practices.

If you have any uncertainties or questions about your dental benefits, don’t hesitate to reach out to your health fund directly. They can provide you with detailed information about your specific coverage and help clarify any concerns you may have.

Should you have any further inquiries please speak to our friendly team at Smile Place Dental.

Author Summary – Dr Chitra Rao

Dr. Chitra Rao has over a decade of experience in dentistry, specifically in the field of cosmetic and orthodontic treatments. Dedicated to achieving optimal results, she takes a detailed and personalised approach to creating beautiful, confident smiles for her patients. Outside of dentistry, Dr. Chitra enjoys staying active, traveling, and spending time with her family.

Struggling with bad breath? You’re not alone.

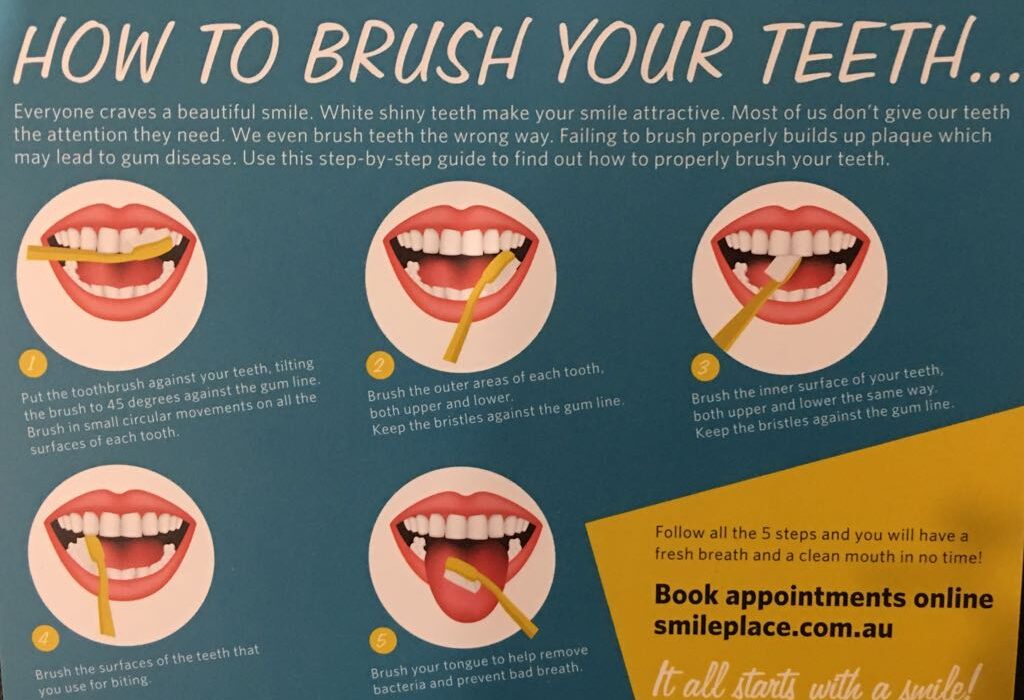

Keep it clean, keep it bright with these simple tips.

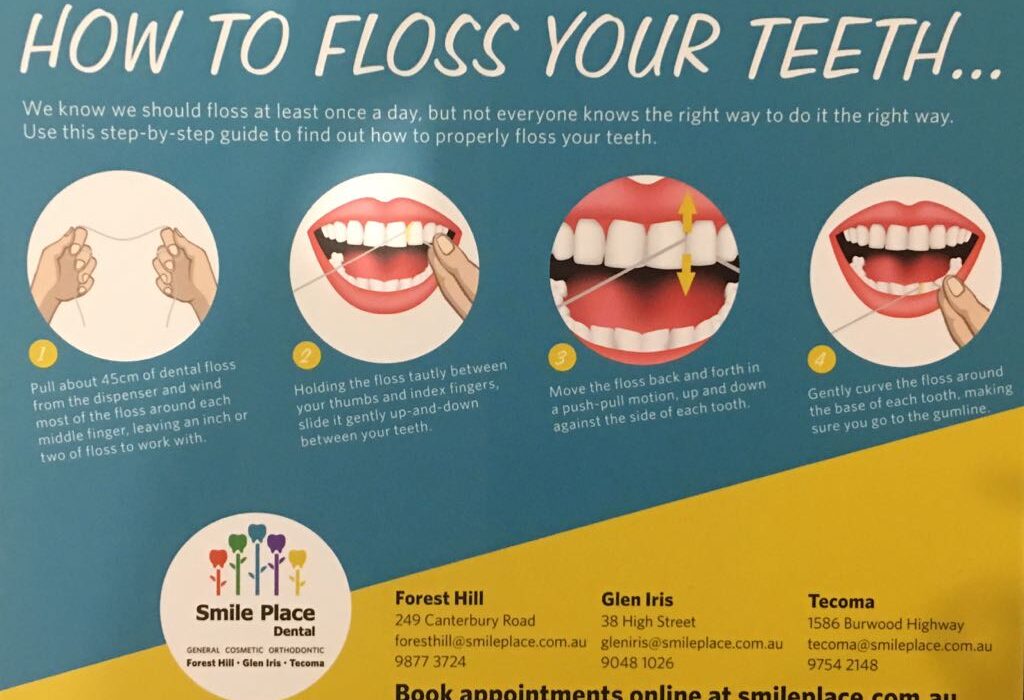

Do you brush twice a day, use a mouthwash, and still struggle with bad breath or surprise cavities? If so, the problem may be caused by inconsistent flossing. Most people skip flossing and those who do floss, often don’t do it right, leaving behind plaque and food debris. The good news? Flossing properly takes just […]